Does Afterpay Take Chime: A Complete Guide To Your Burning Questions

Have you ever wondered if Afterpay works with Chime? Let me tell you, this is one of those questions that pops up more often than you’d think. In today’s world of buy-now-pay-later (BNPL) services, understanding how these platforms interact with your favorite banks and fintech apps is crucial. If you’re using Chime, you’re not alone. Millions of people have turned to this digital bank for its simplicity and convenience. But does Afterpay take Chime? That’s what we’re diving into today, my friend.

Now, let’s face it. The financial landscape has changed drastically over the past few years. Traditional banks are no longer the only game in town. Fintech apps like Chime are gaining popularity because they offer features traditional banks can’t match. But when it comes to Afterpay, the rules can get a little tricky. That’s why we’re breaking it all down for you.

Whether you’re a seasoned Afterpay user or just starting to explore BNPL options, this article will give you the answers you need. From the basics of Afterpay and Chime to the technicalities of linking them together, we’ve got you covered. So, buckle up and let’s dive into the world of digital finance!

Read also:Sex Diva Flawless Your Ultimate Guide To Embracing Inner And Outer Beauty

Understanding Afterpay: What You Need to Know

First things first, let’s talk about Afterpay. If you’ve been living under a rock, Afterpay is a buy-now-pay-later service that lets you split the cost of your purchases into four equal payments over six weeks. No interest, no hidden fees (unless you miss a payment, of course). It’s like having your own personal分期 payment plan without the hassle of traditional loans.

How Does Afterpay Work?

Here’s the deal: Afterpay partners with retailers to offer their service. When you shop at an Afterpay-enabled store, you can choose to pay for your purchase in installments instead of paying the full amount upfront. The first payment is due at the time of purchase, and the remaining three are spread out over the next six weeks.

Now, here’s the catch. To use Afterpay, you’ll need a valid debit or credit card. That’s where things can get a little complicated if you’re using a fintech app like Chime. Not all cards are created equal, and not all of them play nice with Afterpay. We’ll get into that later, but for now, let’s keep rolling.

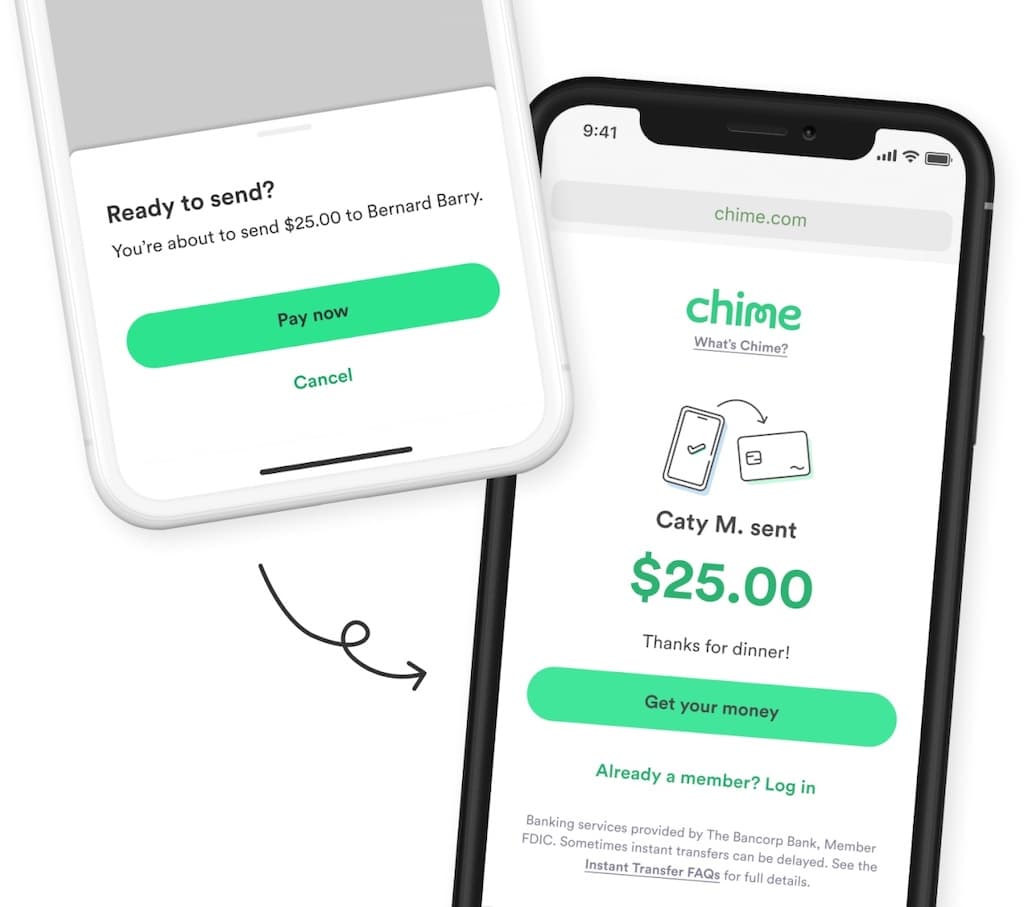

What is Chime? A Quick Overview

Let’s switch gears and talk about Chime. Chime is a digital bank that offers a range of services designed to make your financial life easier. From no-fee checking accounts to automatic savings features, Chime has become a go-to choice for many people looking to simplify their finances.

Key Features of Chime

Here are some of the standout features of Chime:

- No Fees: Chime doesn’t charge monthly maintenance fees, overdraft fees, or foreign transaction fees.

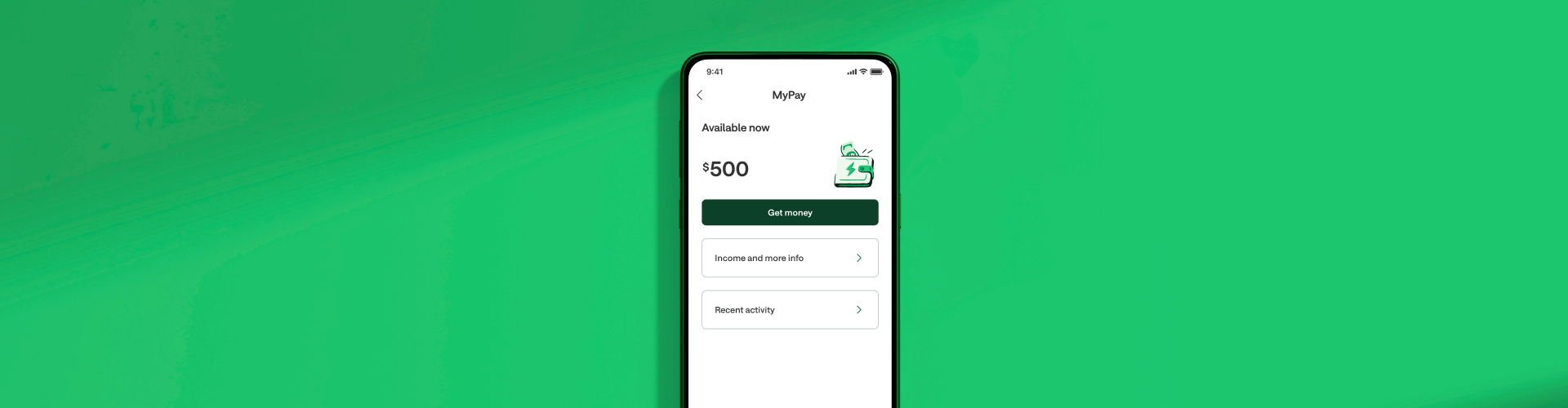

- Instant Deposits: Get paid up to two days early with direct deposit.

- Spending Account: Use your Chime Visa debit card to make purchases anywhere Visa is accepted.

- Automatic Savings: Set up rules to automatically transfer money into your savings account.

Chime is all about making banking simple and accessible. But when it comes to Afterpay, there’s a bit of a gray area. Let’s explore that next.

Read also:Iribitari Gal Nimanko Tsukawasete Morau Hanashi The Intriguing Phenomenon Explained

Does Afterpay Take Chime? The Answer You’ve Been Waiting For

Alright, here’s the million-dollar question: does Afterpay take Chime? The short answer is… it depends. Afterpay requires a valid debit or credit card to process payments. While Chime offers a Visa debit card, there have been reports of mixed results when trying to use it with Afterpay.

Why the Confusion?

The confusion arises because not all debit cards are accepted by Afterpay. Some users have reported success with their Chime debit cards, while others have hit roadblocks. This inconsistency can be frustrating, especially if you’re counting on Afterpay for your next purchase.

So, what’s the deal? Well, it all comes down to how Afterpay verifies card information. If your Chime card passes the verification process, you should be good to go. But if it doesn’t, you might need to explore other options.

Tips for Using Afterpay with Chime

If you’re determined to use Afterpay with your Chime account, here are a few tips to help you out:

1. Check Your Card Type

Make sure your Chime card is a Visa debit card. Afterpay doesn’t accept prepaid or virtual cards, so double-check before you proceed.

2. Verify Your Account

Ensure your Chime account is fully verified. This includes adding your Social Security number and completing any other required steps. A fully verified account increases the chances of your card being accepted by Afterpay.

3. Test Your Card

Try using your Chime card for a small purchase to make sure it’s working properly. If it works for other transactions, it might just work with Afterpay too.

4. Contact Customer Support

If you’re still having trouble, reach out to Chime’s customer support team. They might be able to provide additional insights or solutions.

Alternatives to Afterpay for Chime Users

Let’s say you’ve tried everything, and Afterpay still won’t take your Chime card. Don’t worry, there are plenty of other BNPL options out there. Here are a few alternatives you might want to consider:

1. Klarna

Klarna is another popular BNPL service that works with a wide range of retailers. They accept most major debit and credit cards, so your Chime card might just work with them.

2. Affirm

Affirm offers installment loans for larger purchases. While it’s not exactly the same as Afterpay, it’s a great option if you’re looking to spread out the cost of a big-ticket item.

3. Sezzle

Sezzle is another BNPL service that lets you pay for purchases in four interest-free installments. They accept most major debit and credit cards, so your Chime card might just work with them.

Benefits of Using Afterpay

Now that we’ve covered the basics, let’s talk about why Afterpay is such a popular choice for so many people. Here are a few benefits to consider:

1. Interest-Free Payments

Afterpay doesn’t charge interest on your purchases, which makes it a great option for budget-conscious shoppers.

2. Flexible Payment Plans

With Afterpay, you can spread out the cost of your purchases over six weeks, making it easier to manage your expenses.

3. No Credit Checks

Unlike traditional loans, Afterpay doesn’t require a credit check. This makes it accessible to people with all credit scores.

Challenges of Using Afterpay with Chime

While Afterpay and Chime can work together in theory, there are a few challenges to keep in mind:

1. Card Acceptance Issues

As we’ve already discussed, not all Chime cards are accepted by Afterpay. This can be frustrating if you’re counting on the service for your next purchase.

2. Payment Delays

Even if your Chime card is accepted, there’s always a chance of payment delays. This can happen if your card information needs to be verified or if there are issues with your Chime account.

3. Limited Retailer Options

Afterpay isn’t available at every retailer, so you might need to shop around to find stores that accept it.

Data and Statistics: The Numbers Behind BNPL

According to a recent study, the buy-now-pay-later market is expected to reach $18.8 billion by 2027. That’s a massive growth from just a few years ago, and it’s no surprise given the popularity of services like Afterpay.

In the U.S. alone, over 100 million people have used BNPL services at least once. And with more retailers adopting these platforms, the trend is only expected to continue.

Final Thoughts: Does Afterpay Take Chime?

So, does Afterpay take Chime? The answer is still a bit murky, but with the right steps, it’s definitely possible. By verifying your account, testing your card, and reaching out to customer support, you can increase your chances of success.

Remember, if Afterpay doesn’t work for you, there are plenty of other BNPL options out there. Don’t be afraid to explore your options and find the service that works best for your needs.

And most importantly, always shop responsibly. While BNPL services can be a great tool, they’re not a substitute for good financial habits. So, stay smart, stay informed, and keep your finances on track.

Table of Contents

- Understanding Afterpay: What You Need to Know

- What is Chime? A Quick Overview

- Does Afterpay Take Chime? The Answer You’ve Been Waiting For

- Tips for Using Afterpay with Chime

- Alternatives to Afterpay for Chime Users

- Benefits of Using Afterpay

- Challenges of Using Afterpay with Chime

- Data and Statistics: The Numbers Behind BNPL

- Final Thoughts: Does Afterpay Take Chime?

That’s a wrap, folks! I hope this article has answered all your questions about Afterpay and Chime. If you have any thoughts or experiences to share, feel free to drop a comment below. And don’t forget to share this article with your friends who might find it helpful. Until next time, stay financially savvy!